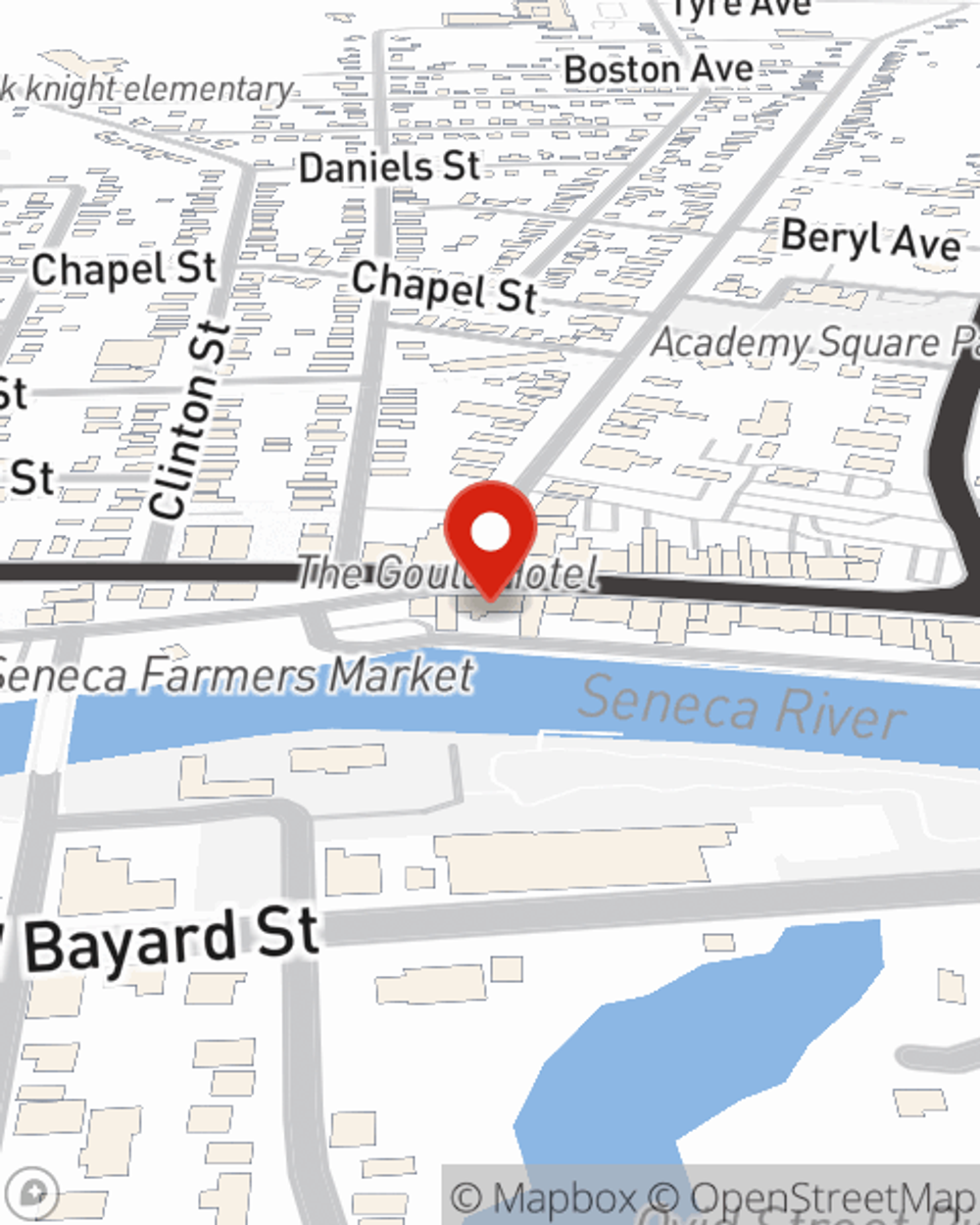

Business Insurance in and around Seneca Falls

One of the top small business insurance companies in Seneca Falls, and beyond.

Helping insure small businesses since 1935

- Finger Lakes

- Wayne County

- Seneca County

- Seneca Falls

- Waterloo

- Geneva

- Ovid

- Romulus

- Fayette

- Trumansburg

- Watkins Glen

- Ithaca

- Savannah

- Clyde

- Cayuga County

- Ontario County

- Union Springs

- Cayuga

- Clifton Springs

- Canandaigua

- Montezuma

- New York

- Syracuse

- upstate New York

Help Protect Your Business With State Farm.

Whether you own a a confectionary, a cosmetic store, or a window treatment store, State Farm has small business insurance that can help. That way, amid all the various moving pieces and decisions, you can focus on your next steps.

One of the top small business insurance companies in Seneca Falls, and beyond.

Helping insure small businesses since 1935

Keep Your Business Secure

Your small business is unique and faces specific challenges. Whether you are growing a camera store or a shoe repair shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Jim Bruning can help with extra liability coverage as well as employment practices liability insurance.

The right coverages can help keep your business safe. Consider contacting State Farm agent Jim Bruning's office today to discover your options and get started!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Jim Bruning

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.